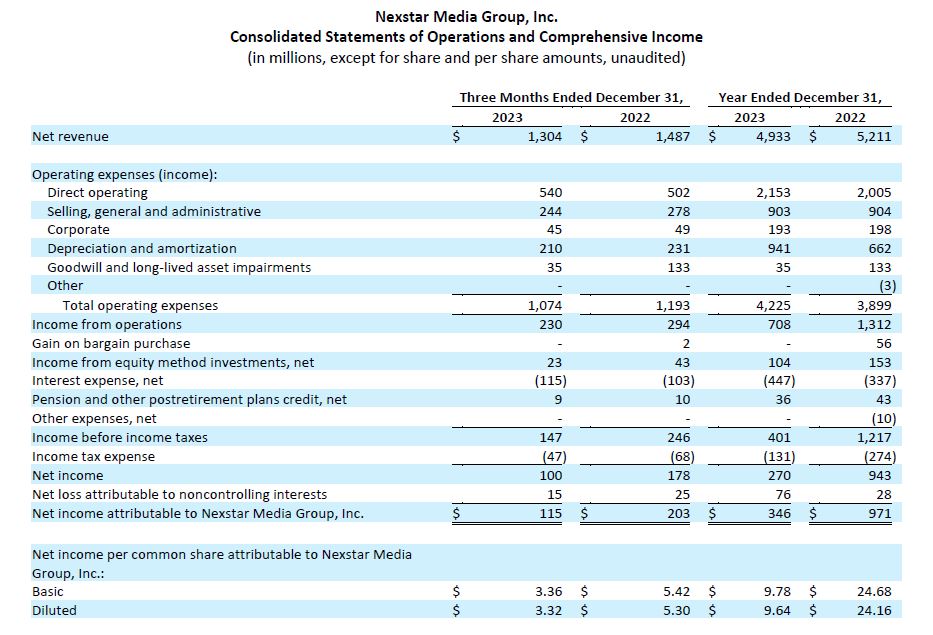

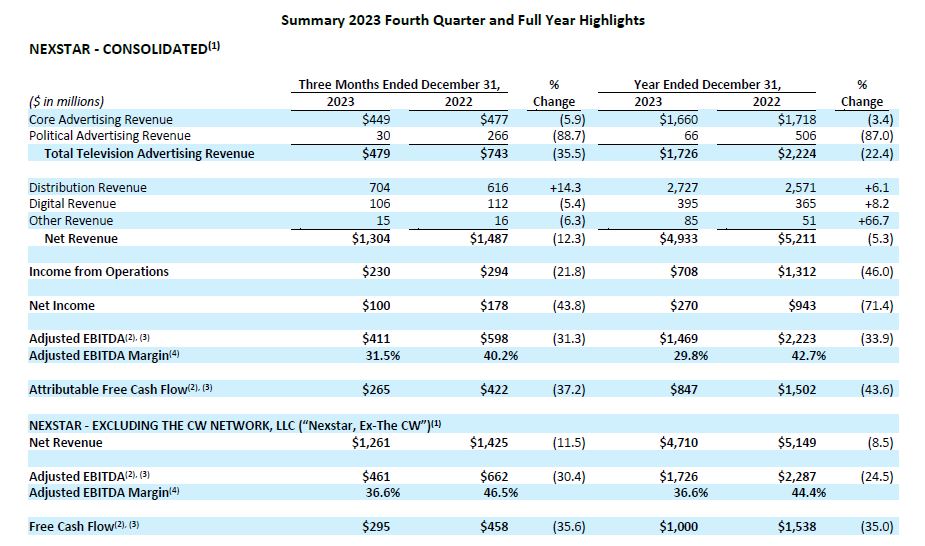

Nexstar Media Group Reports Fourth Quarter Net Revenue of $1.3 Billion

Q4 Consolidated Net Revenue Drives Operating Income of $230 Million, Net Income of $100 Million,

Consolidated Adjusted EBITDA of $411 Million and Attributable Free Cash Flow of $265 Million

Quarterly and Full Year Return of Capital to Shareholders of $137 Million and $796 Million, Respectively,

Reduced Shares Outstanding by 8.7% during 2023

Issues 2024 Adjusted EBITDA Guidance of $2.085 Billion to $2.195 Billion

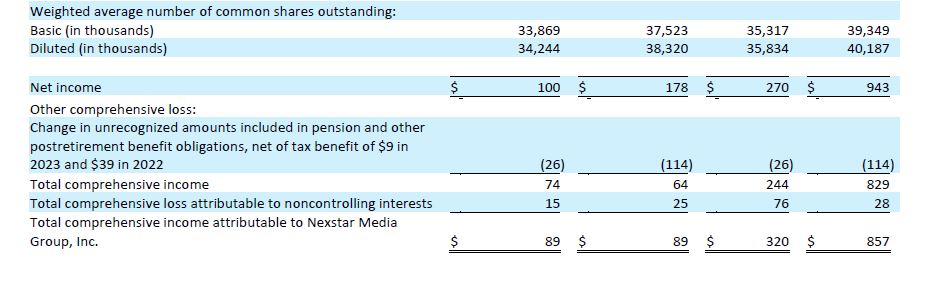

IRVING, Texas – February 28, 2024 – Nexstar Media Group, Inc. (NASDAQ: NXST) (“Nexstar” or the “Company”) today reported financial results for the fourth quarter and year ended December 31, 2023 as summarized below:

CEO Comment

Perry A. Sook, Nexstar’s Chairman and Chief Executive Officer, commented, “Nexstar’s fourth quarter financial results outperformed consensus expectations in key financial metrics including Adjusted EBITDA and Attributable Free Cash Flow. Our 2023 results extend Nexstar’s long record of consistently generating substantial free cash flow, and we expect that trend to continue. To that end, in January we announced an increase in our annual dividend by 25%, our thirteenth consecutive increase.

“The power of the broadcast model and its ability to reach the largest audience of any medium with important news, sports and entertainment content is as strong as ever, reflected by the record audience delivery for NFL and Super Bowl, Grammys and other live sports and event programming. Validating the enduring strength, reach and appeal of broadcast, during the fourth quarter we successfully completed all of our remaining distribution negotiations without interruption, as our distribution partners, their customers and our audience value the highest-rated broadcast and fastest-growing cable news network programming we provide. The completion of these and other recent distribution agreements provide solid visibility for our distribution revenues in 2024 and beyond. As we move into 2024, an election year, we look forward to once again demonstrating the value of broadcast television to candidates and campaigns looking to communicate to the electorate through political advertising on television.

“Our strong financial track record supports our commitment to shareholder returns and the enhancement of shareholder value. On average, for the 2022/2023 cycle, Nexstar generated $1.8 billion of Adjusted EBITDA and $1.2 billion of Attributable Free Cash Flow. Over that time frame, we returned an average of $910 million each year to shareholders in the form of dividends and share repurchases, representing approximately 77% of our average Attributable Free Cash Flow. We expect to continue to use our cash flow to maximize shareholder returns.”

Fourth Quarter and Full Year 2023 Operational Highlights

- Successfully renewed distribution agreements representing more than 40% of our subscriber base on terms favorable to the Company, positioning Nexstar to deliver further annual distribution revenue growth.

- Renewed and extended multi-year affiliation agreements with the Fox Network, MyNetworkTV and The CW Network.

- Launched CW Network affiliations on Nexstar owned and operated television stations in five markets, including three of the nation’s top-15 television markets, bringing the number of Nexstar and partner-owned CW affiliates to 45, covering more than 39% of U.S. TV Households.

- Expanded and extended CW Network affiliation agreements with several broadcast affiliate partners.

- Secured or extended exclusive broadcast rights for The CW Network to WWE NXT, LIV Golf, Atlantic Coast Conference (ACC) college football and basketball games, and NASCAR Xfinity Series.

- NewsNation marked a major cable news milestone by becoming a 24/5 news network and remains America’s fastest growing cable news network in primetime.

- NewsNation hosted the final GOP Presidential primary debate before the Iowa caucuses, which was simulcast on The CW. The event delivered more than 4 million combined viewers with NewsNation garnering the largest audience in its three-year history, and the CW simulcast representing the most watched primetime program on the network since 2018.

- Completed first upfront as a consolidated entity for all Nexstar national properties including NewsNation, The CW, Antenna TV, and The Hill adding 47 new advertisers across these platforms.

- Led the industry in deployment of ATSC 3.0, or NextGen TV, with more than 58 million U.S. television households now receiving a NextGen TV signal from a Nexstar-owned or partner station.

- Closed the acquisitions of KUSI-TV, an independent station and local news powerhouse in San Diego, CA, the nation’s 30th largest television market, and WSNN-LD, a MyNetworkTV affiliated low power television station serving the Tampa, FL market.

Fourth Quarter 2023 Financial Highlights

- Fourth quarter net revenue of $1.3 billion compared to $1.5 billion in the prior year quarter.

- The net revenue comparison primarily reflects the year-over-year decline in cyclical political advertising, offset, in part, by growth in our distribution revenue.

- Excluding political advertising revenue, net revenue increased 4.3% year-over-year.

- Approximately 55% of Nexstar’s fourth quarter revenue was generated by distribution and other revenue streams.

- Fourth quarter core advertising revenue of approximately $449 million decreased 5.9% year-over-year.

- Core television advertising was impacted by continued softness in the advertising market.

- Fourth quarter political advertising revenue of approximately $30 million compared to $266 million in the prior year.

- The reduction in political television advertising was due to the lack of material election activity in odd years.

- Record fourth quarter distribution revenue of approximately $704 million increased 14.3% versus prior year.

- Distribution revenue growth was driven by the renewal of the substantial majority of our distribution agreements in 2022 and 2023 on improved terms and annual rate escalators, as well as growth in virtual MVPD revenue, offset, in part, by continued MVPD subscriber attrition and the removal of partner stations from certain MVPDs.

- Fourth quarter digital revenue of approximately $106 million decreased 5.4% year-over-year.

- Digital revenue was primarily impacted by weakness in national digital advertising, partially offset by year-over-year increases in Nexstar’s local digital advertising revenue and agency services business and ecommerce.

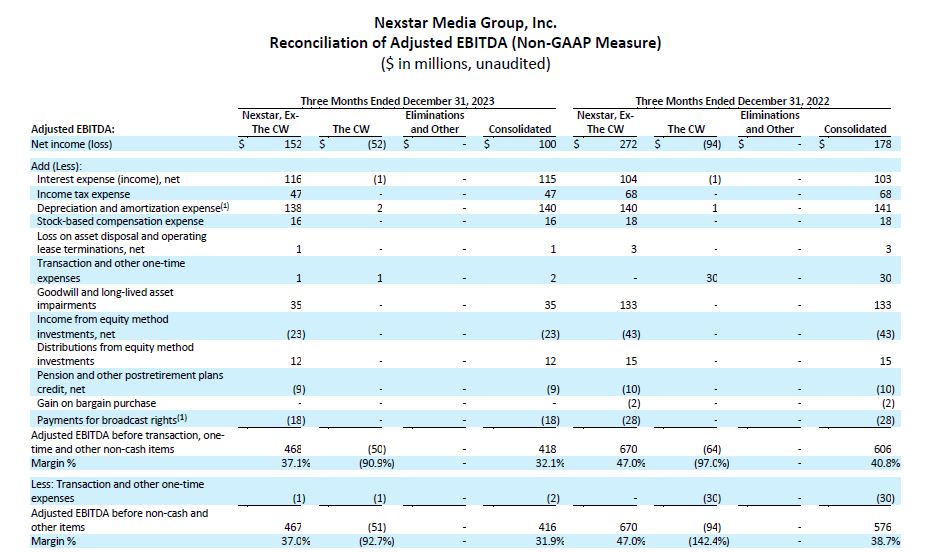

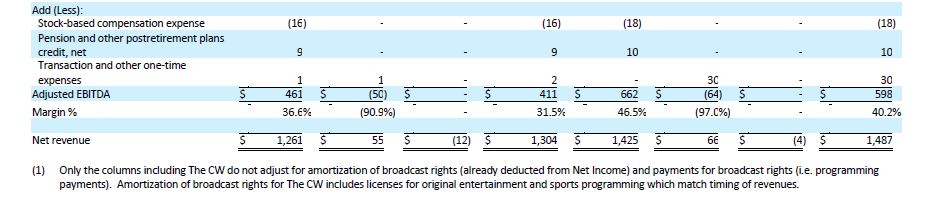

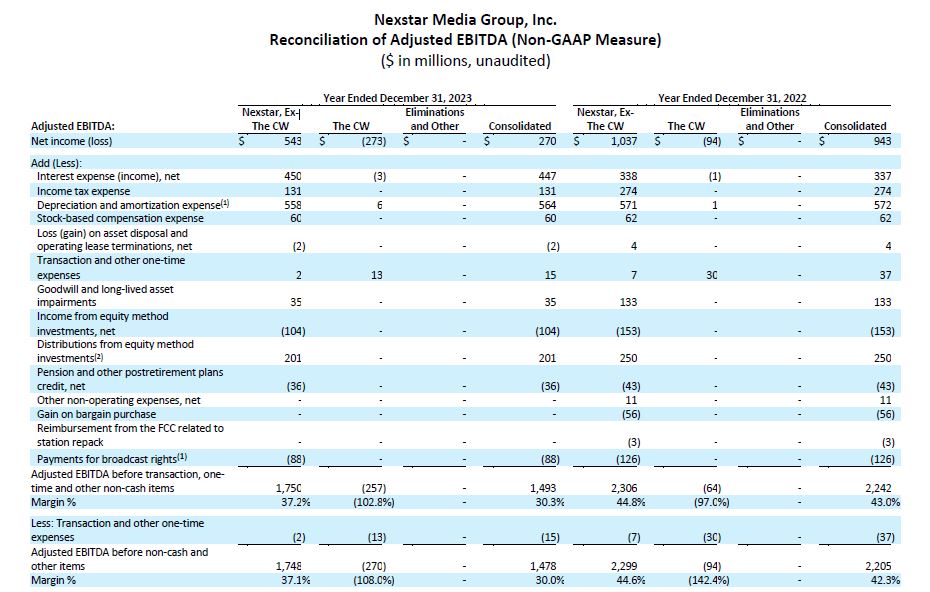

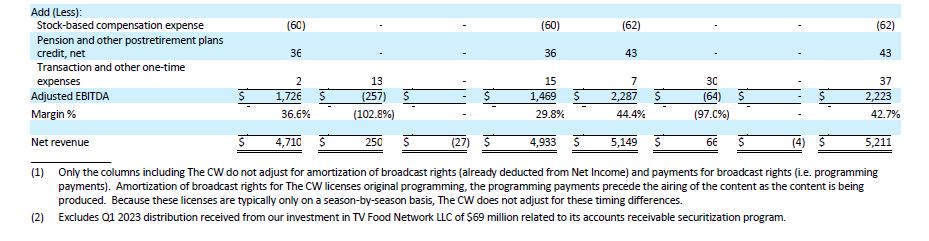

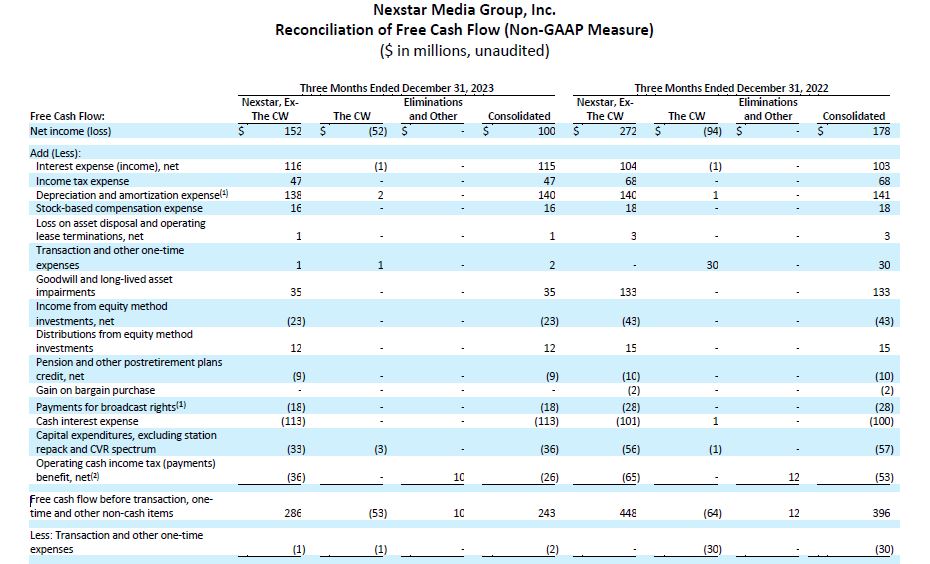

- On a consolidated basis, fourth quarter Adjusted EBITDA was $411 million, representing a 31.5% margin, and fourth quarter attributable free cash flow was $265 million.

- Fourth quarter Adjusted EBITDA was primarily impacted by the reduction in net revenue year-over-year.

- Excluding The CW Network, fourth quarter Adjusted EBITDA was $461 million.

- In the fourth quarter of 2023, the Company used cash on hand and cash flow from operations to:

- Return $137 million to shareholders through the repurchase of 629,469 shares of Nexstar’s common stock at an average price of approximately $145.13 per share for a total of $91 million (excluding $5 million that was used to repurchase stock in September and settled in October), and quarterly cash dividend payments of $46 million;

- Reduce debt by approximately $32 million.

Debt and Leverage Review

- The consolidated debt of Nexstar and Mission Broadcasting, Inc. (“Mission”), an independently owned variable interest entity, at December 31, 2023 was $6.84 billion, including senior secured debt of $4.13 billion.

- The Company calculates its leverage ratios in accordance with the terms of its credit agreements which ratios only include Nexstar, excluding The CW Network’s operations and cash balance. As of December 31, 2023, The CW Network had $52 million of cash on its balance sheet.

- The Company’s first lien net leverage ratio at December 31, 2023 was 2.25x compared to a covenant of 4.25x.

- The Company’s total net leverage ratio at December 31, 2023 was 3.76x.

The table below summarizes the Company’s debt obligations (net of financing costs, discounts and/or premiums).

Full-Year 2024 Guidance

Based on our current outlook, we are establishing guidance for fiscal 2024 Adjusted EBITDA in a range of $2.085 billion to $2.195 billion.

Key factors differing from our current expectations could affect our outlook for Adjusted EBITDA for 2024 either positively or negatively. Those factors include, among other things, the amount of political fundraising and spend on television advertising in our markets, the rate of growth or attrition of pay television subscribers, the health of the local and national advertising markets, the ability to renegotiate affiliation agreements on favorable terms, and the level of distributions related to our 31.3% ownership stake in TV Food Network.

Fourth Quarter Conference Call

Nexstar will host a conference call at 10:00 a.m. ET today. Senior management will discuss the financial results and host a question-and-answer session. The dial in number for the audio conference call is +1 877-407-9208 or +1 201-493-6784, conference ID 13743674 (domestic and international callers). Participants can also listen to a live webcast of the call through the “Events and Presentations” section under “Investor Relations” on Nexstar’s website at nexstar.tv. A webcast replay will be available for 90 days following the live event at nexstar.tv.

Definitions and Disclosures Regarding non-GAAP Financial Information

Nexstar Media Inc., a wholly-owned subsidiary of the Company, acquired a 75% ownership interest in The CW on September 30, 2022 and designated The CW as an “Unrestricted Subsidiary” as permitted under the terms of its debt agreements. The financial results for The CW are included in the financial presentation herein from that date forward. The financial results of The CW, the Company’s only Unrestricted Subsidiary, and associated eliminations are excluded from the calculation of the Company’s leverage ratio for purposes of compliance with its financial covenant.

Adjusted EBITDA is calculated as net income, plus interest expense (net), loss on extinguishment of debt, income tax expense (benefit), depreciation and amortization expense (excluding amortization of broadcast rights for The CW), (gain) loss on asset disposal, transaction and other one-time expenses, impairment charges, (income) loss from equity method investments, distributions from equity method investments and other expense (income), minus reimbursement from the FCC related to station repack and broadcast rights payments (excluding broadcast rights payments for The CW). We consider Adjusted EBITDA to be an indicator of our assets’ operating performance and a measure of our ability to service debt. It is also used by management to identify the cash available for strategic acquisitions and investments, maintain capital assets and fund ongoing operations and working capital needs. We also believe that Adjusted EBITDA is useful to investors and lenders as a measure of valuation.

Adjusted EBITDA for Nexstar – Excluding The CW Network, LLC is calculated as Consolidated Adjusted EBITDA, less the Adjusted EBITDA of The CW and Eliminations.

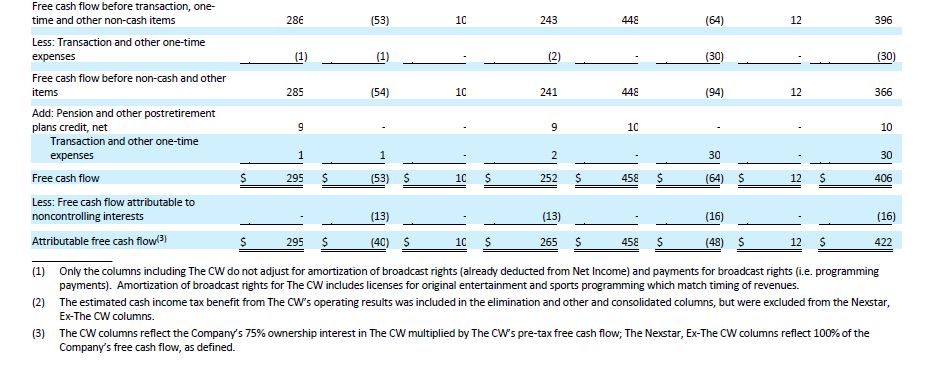

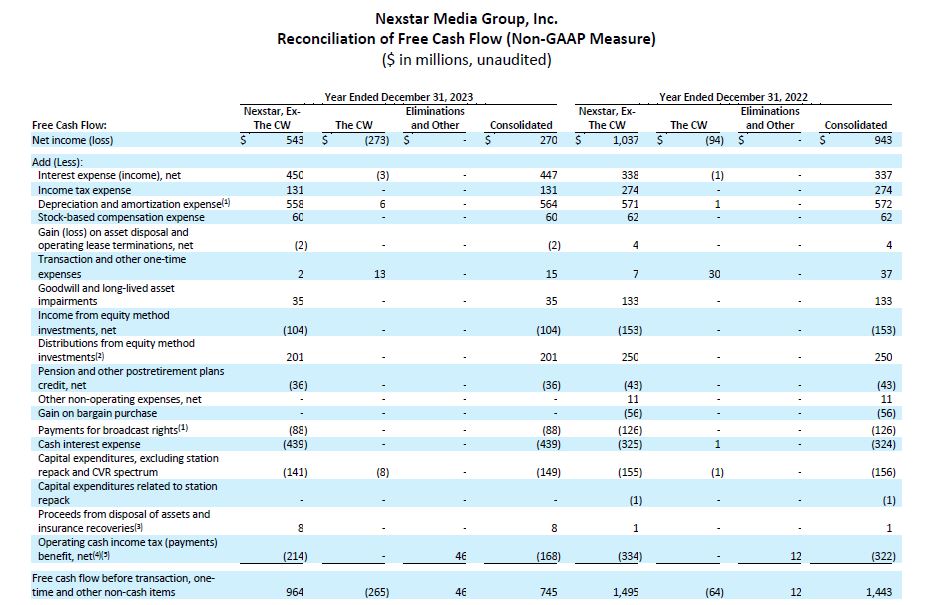

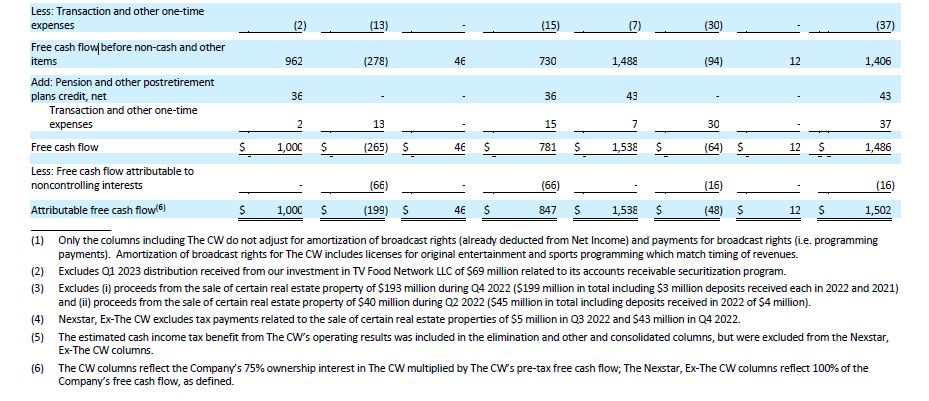

Free cash flow is calculated as net income, plus interest expense (net), loss on extinguishment of debt, income tax expense (benefit), depreciation and amortization expense (excluding amortization of broadcast rights for The CW), stock-based compensation expense, (gain) loss on asset disposal, transaction and other one-time expenses, impairment charges, (income) loss from equity method investments, distributions from equity method investments and other expense (income), minus payments for broadcast rights (excluding broadcast rights payments for The CW), cash interest expense, capital expenditures, proceeds from disposal of assets and insurance recoveries, and operating cash income tax payments. We consider Free Cash Flow to be an indicator of our assets’ operating performance. In addition, this measure is useful to investors because it is frequently used by industry analysts, investors and lenders as a measure of valuation for broadcast companies, although their definitions of Free Cash Flow may differ from our definition.

Attributable Free Cash Flow is calculated as Consolidated Free Cash Flow, less free cash flow of The CW attributable to its noncontrolling interests.

Free Cash Flow for Nexstar – Excluding The CW Network, LLC is calculated as Consolidated Free Cash Flow, less the free cash flow of The CW and Eliminations.

For a reconciliation of these non-GAAP financial measurements to the GAAP financial results cited in this news announcement, please see the supplemental tables at the end of this release.

With respect to our forward-looking guidance, no reconciliation between a non-GAAP measure to the closest corresponding GAAP measure is included in this release because we are unable to quantify certain amounts that would be required to be included in the GAAP measure without unreasonable efforts. We believe such reconciliations would imply a degree of precision that would be confusing or misleading to investors. In particular, a reconciliation of forward-looking Free Cash Flow to the closest corresponding GAAP measure is not available without unreasonable efforts on a forward-looking basis due to the high variability, complexity and low visibility with respect to the charges excluded from these non-GAAP measures. For example, the definition of Free Cash Flow excludes stock-based compensation expenses specific to equity compensation awards that are directly impacted by unpredictable fluctuations in our stock price. In addition, the definition of Free Cash Flow excludes the impact of non-recurring or unusual items such as impairment charges, transaction-related costs and gains or losses on sales of assets which are unpredictable. We expect the variability of these items to have a significant, and potentially unpredictable, impact on our future GAAP financial results.

About Nexstar Media Group, Inc.

Nexstar Media Group, Inc. (NASDAQ: NXST) is a leading diversified media company that produces and distributes engaging local and national news, sports and entertainment content across its television and digital platforms, including more than 310,000 hours of programming produced annually by its business units. Nexstar owns America’s largest local television broadcasting group comprised of top network affiliates, with over 200 owned or partner stations in 117 U.S. markets reaching 220 million people. Nexstar’s national television properties include The CW, America’s fifth major broadcast network, NewsNation, America’s fastest-growing national cable news network, popular entertainment multicast networks Antenna TV and Rewind TV, and a 31.3% ownership stake in TV Food Network. The Company’s portfolio of digital assets, including its local TV station websites, The Hill and NewsNationNow.com, are collectively a Top 10 U.S. digital news and information property. For more information, please visit nexstar.tv.

Forward-Looking Statements

This communication includes forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events. Forward-looking statements include information preceded by, followed by, or that includes the words “guidance,” “believes,” “expects,” “anticipates,” “could,” or similar expressions. For these statements, Nexstar claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The forward-looking statements contained in this communication, concerning, among other things, future financial performance, including changes in net revenue, operating expenses and cash flow, involve risks and uncertainties, and are subject to change based on various important factors, including the impact of changes in national and regional economies, the ability to service and refinance our outstanding debt, successful integration of business acquisitions (including achievement of synergies and cost reductions), pricing fluctuations in local and national advertising, future regulatory actions and conditions in the television stations’ operating areas, competition from others in the broadcast television markets, volatility in programming costs, the effects of governmental regulation of broadcasting, industry consolidation, technological developments and major world news events. Nexstar undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this communication might not occur. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this release. For more details on factors that could affect these expectations, please see Nexstar’s other filings with the Securities and Exchange Commission.

Investor Contacts:

Lee Ann Gliha

Executive Vice President and Chief Financial Officer

Nexstar Media Group, Inc.

972/373-8800

Joe Jaffoni, Jennifer Neuman

JCIR

212/835-8500 or nxst@jcir.com

Media Contact:

Gary Weitman

EVP and Chief Communications Officer

Nexstar Media Group, Inc.

972/373-8800 or gweitman@nexstar.tv